Apple CEO Tim Cook is Hole in law (2020) Watch onlinenot pleased by a recent European Commission ruling that stated Apple must pay Ireland $14.5 billion in unpaid taxes.

Cook wrote in a letter, published on Apple's website, the ruling is an attempt to rewrite Irish tax law, and has "no basis in fact or law." The Irish government agrees with Apple, and the two plan to appeal the decision.

SEE ALSO: Inside Home: Apple’s plan to finally give you a smarter house"We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don't owe them any more than we've already paid," Cook said.

Cook's letter told a brief story of Apple's work force in Ireland, and said the company is "committed" to the country.

You can read the letter in full, below.

Thirty-six years ago, long before introducing iPhone, iPod or even the Mac, Steve Jobs established Apple’s first operations in Europe. At the time, the company knew that in order to serve customers in Europe, it would need a base there. So, in October 1980, Apple opened a factory in Cork, Ireland with 60 employees.

At the time, Cork was suffering from high unemployment and extremely low economic investment. But Apple’s leaders saw a community rich with talent, and one they believed could accommodate growth if the company was fortunate enough to succeed.

We have operated continuously in Cork ever since, even through periods of uncertainty about our own business, and today we employ nearly 6,000 people across Ireland. The vast majority are still in Cork — including some of the very first employees — now performing a wide variety of functions as part of Apple’s global footprint. Countless multinational companies followed Apple by investing in Cork, and today the local economy is stronger than ever.

The success which has propelled Apple’s growth in Cork comes from innovative products that delight our customers. It has helped create and sustain more than 1.5 million jobs across Europe — jobs at Apple, jobs for hundreds of thousands of creative app developers who thrive on the App Store, and jobs with manufacturers and other suppliers. Countless small and medium-size companies depend on Apple, and we are proud to support them.

As responsible corporate citizens, we are also proud of our contributions to local economies across Europe, and to communities everywhere. As our business has grown over the years, we have become the largest taxpayer in Ireland, the largest taxpayer in the United States, and the largest taxpayer in the world.

Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law — the same kind of guidance available to any company doing business there. In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe.

The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don't owe them any more than we've already paid.

The Commission’s move is unprecedented and it has serious, wide-reaching implications. It is effectively proposing to replace Irish tax laws with a view of what the Commission thinks the law should have been. This would strike a devastating blow to the sovereignty of EU member states over their own tax matters, and to the principle of certainty of law in Europe. Ireland has said they plan to appeal the Commission’s ruling and Apple will do the same. We are confident that the Commission’s order will be reversed.

At its root, the Commission’s case is not about how much Apple pays in taxes. It is about which government collects the money.

Taxes for multinational companies are complex, yet a fundamental principle is recognized around the world: A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.

In Apple’s case, nearly all of our research and development takes place in California, so the vast majority of our profits are taxed in the United States. European companies doing business in the U.S. are taxed according to the same principle. But the Commission is now calling to retroactively change those rules.

Beyond the obvious targeting of Apple, the most profound and harmful effect of this ruling will be on investment and job creation in Europe. Using the Commission’s theory, every company in Ireland and across Europe is suddenly at risk of being subjected to taxes under laws that never existed.

Apple has long supported international tax reform with the objectives of simplicity and clarity. We believe these changes should come about through the proper legislative process, in which proposals are discussed among the leaders and citizens of the affected countries. And as with any new laws, they should be applied going forward — not retroactively.

We are committed to Ireland and we plan to continue investing there, growing and serving our customers with the same level of passion and commitment. We firmly believe that the facts and the established legal principles upon which the EU was founded will ultimately prevail.

Tim Cook

Have something to add to this story? Share it in the comments.

Shop the iPad Air and iPad 11th generation for their lowest

Shop the iPad Air and iPad 11th generation for their lowest

The Cult Appeal of Kyril Bonfiglioli‘s “Mortdecai” Novels

The Cult Appeal of Kyril Bonfiglioli‘s “Mortdecai” Novels

QAnon Shaman Jacob Chansley receives 41 month prison for role in Capitol riot

QAnon Shaman Jacob Chansley receives 41 month prison for role in Capitol riot

Staff Picks: Kathy Acker, Egon Schiele, Elena Ferrante, and More

Staff Picks: Kathy Acker, Egon Schiele, Elena Ferrante, and More

Amazon Spring Sale 2025: Best deals on cleaning supplies

Amazon Spring Sale 2025: Best deals on cleaning supplies

Taylor Swift TikTok is the perfect place for fans new and old

Taylor Swift TikTok is the perfect place for fans new and old

Shying by Sadie Stein

Shying by Sadie Stein

'Quordle' today: See each 'Quordle' answer and hints for September 13, 2023

'Quordle' today: See each 'Quordle' answer and hints for September 13, 2023

Contingent No More

Contingent No More

iPhone 14 vs iPhone 15 price comparison: Which is the better value?

iPhone 14 vs iPhone 15 price comparison: Which is the better value?

Meta continues its submission to Trump with new advisor on its board

Meta continues its submission to Trump with new advisor on its board

Apple iPhone 15 launch event forgot to bring the fun

Apple iPhone 15 launch event forgot to bring the fun

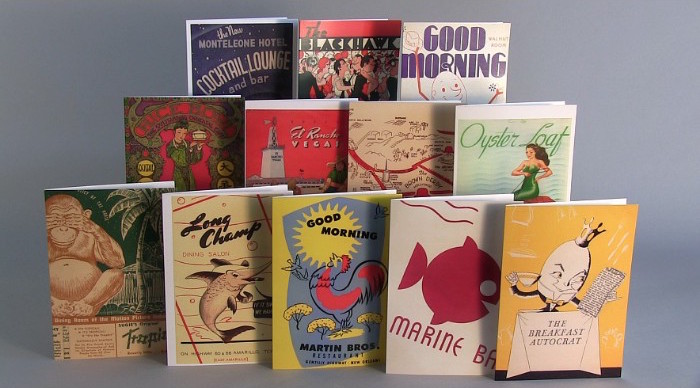

For Bonnie Slotnick’s Cookbook Store, a Fresh Start

For Bonnie Slotnick’s Cookbook Store, a Fresh Start

In Tolstoy’s Diaries, Self

In Tolstoy’s Diaries, Self

The Sound and the “Furious”

The Sound and the “Furious”

Those Moments When You Feel Like You’ve Mastered Adulthood

Those Moments When You Feel Like You’ve Mastered Adulthood

William James Hated to Be Photographed

William James Hated to Be Photographed

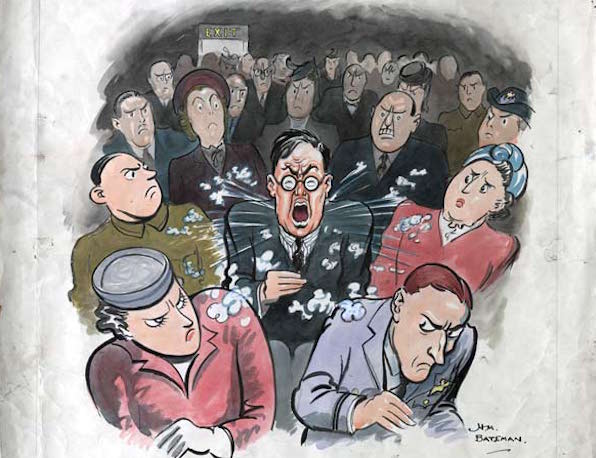

The Perfect Metaphor for the Common Cold: Internet Trolls

The Perfect Metaphor for the Common Cold: Internet Trolls

Best JBL deal: Save $80 on JBL Xtreme 4 portable speaker

Best JBL deal: Save $80 on JBL Xtreme 4 portable speaker

Small Wonder by Sadie Stein

Small Wonder by Sadie Stein

Arctic sea ice drops below a grim benchmark in 2020*Really* miss flying? Join over 100 other weirdos on this 7TikTok, Oracle confirm broad strokes of a deal to avert U.S. app banKate, William and Harry want to connect with you on LinkedInBird's Air eNBC's Peacock finally arrives on Roku two months after launchThe livestreaming boom isn't slowing down anytime soonRuth Bader Ginsburg's best pop culture momentsForget Yelp: Some of the best writing on the web is at IWasPoisoned.comEverything coming to Disney+ in October 2020Man wishes daughter happy birthday with a dad joke, wins the heart of the internetTrump's flawless sketch of the NYC skyline is now set for auctionSean Spicer apparently stole a miniThe best messaging apps not owned by FacebookPandemmys highlights: The best and worst moments of the 2020 EmmysHow to support women in detention centers as ICE investigates forced sterilization complaintMadame Tussauds reinstates Beyoncé wax figure after lighting adjustmentsSean Spicer apparently stole a miniBusiness witches of Instagram: How sorcery found a commercial home on social mediaThe livestreaming boom isn't slowing down anytime soon Curb Your Enthusiasm Glossary of Wiltshire Words Announcing Issue 209! The Sabbathday Lake Community and Early Shaker Spirituals Taxonomy by Sadie Stein Recapping Dante: Canto 30, or Triple X Project Angel Raid Drunk Texts from Famous Authors Phantom Limb by Daniel Bosch The Morning News Roundup for May 21, 2014 The Morning News Roundup for May 30, 2014 Out of Joint by Jonathan Wilson Croatia, a Work in Progress by David Gendelman Happy Birthday, William Crookes! Field Geology: An Interview with Rivka Galchen by Alice Whitwham The Morning News Roundup for June 2, 2014 Signs and Wonders: In the Studio with Hayal Pozanti by Joseph Akel I’d Like to Make You Smile Morning Roundup of July 17, 2014 Painkillers, God, and America by Jonathan Wilson

2.467s , 10133.484375 kb

Copyright © 2025 Powered by 【Hole in law (2020) Watch online】,Fresh Information Network